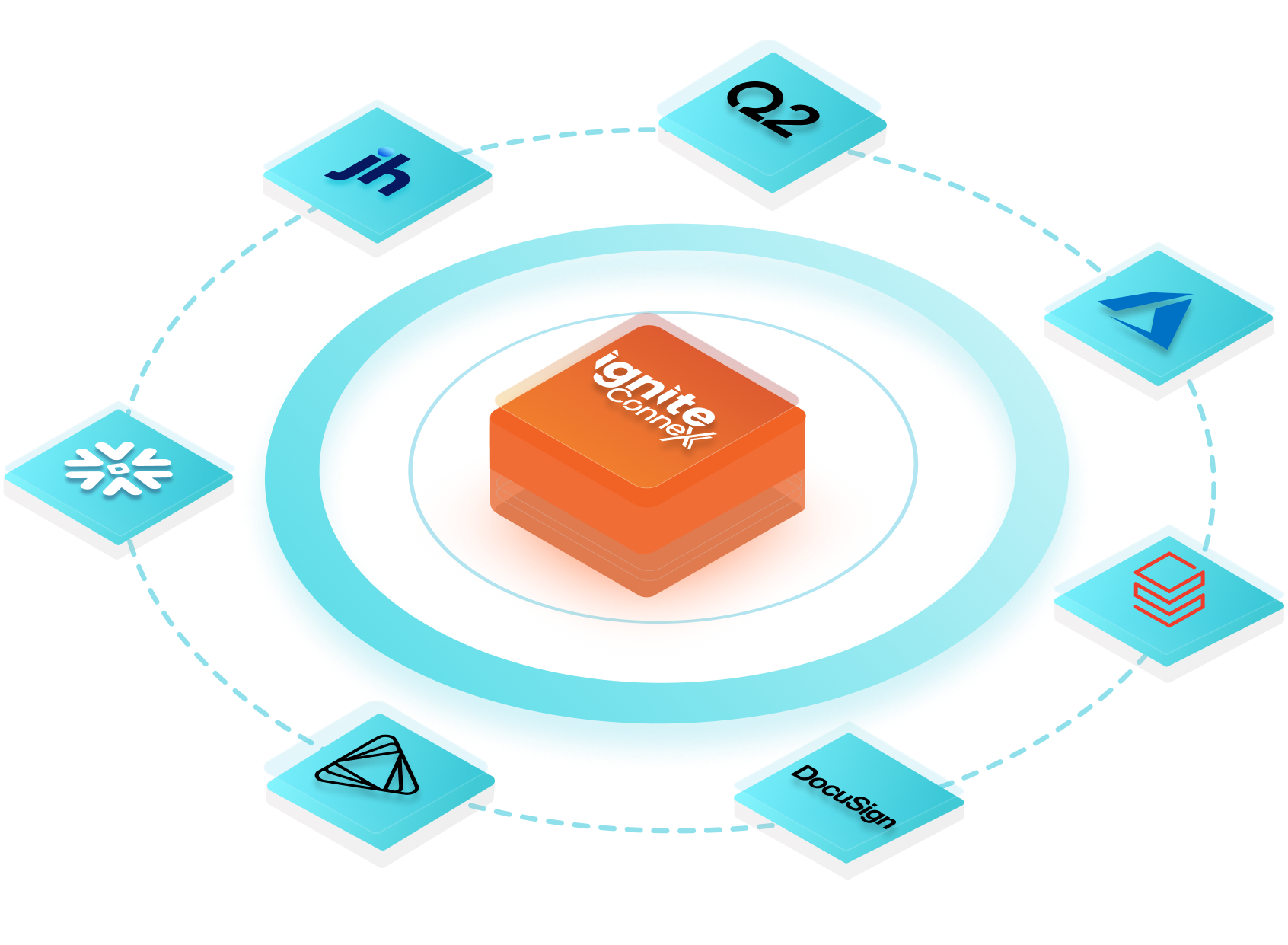

In this whitepaper, the focus is on how the API Cloud solution revolutionizes integration and API development in the banking sector. It addresses the challenges faced by banks in integrating various systems and maintaining a robust API infrastructure. The paper details the strategic advantages of using an API Cloud, such as cost efficiency, rapid time-to-market, scalability, and compliance with stringent security standards. It presents use cases demonstrating how the API Cloud empowers banks to enhance their IT strategies, streamline operations, and foster innovation.

Download the whitepaper to discover how the API Cloud can transform your bank’s digital capabilities, ensuring a competitive edge in today’s dynamic financial landscape.

Click here to download: IgniteConnex-API-Cloud

The Transformative Role of Integrations for Commercial Lenders and their Clients

In the fast-paced world of commercial lending, where agility and precision are paramount, harnessing the capabilities of integration platforms, such as IgniteConnex, emerges as a strategic imperative. These platforms serve as catalysts for seamless collaboration, streamlined processes, and enhanced communication between banks, commercial lenders, and their clients. Let’s delve into how an integration platform can revolutionize the landscape, benefiting both lenders and their valued clientele.

Streamlining Workflows for Commercial Lenders

-

Efficient Data Exchange:

Integration platforms break down silos by enabling smooth data exchange between various systems used by commercial lenders. This means quick access to critical information, eliminating manual data entry, and reducing the risk of errors.

-

Accelerated Decision-Making:

By automating workflows and data processing, integration platforms empower commercial lenders to make faster and more informed decisions. This agility is crucial in a dynamic business environment where time is often of the essence.

-

Unified View of Customer Data:

Integration consolidates customer data from disparate sources into a unified view. This holistic perspective allows lenders to understand the financial health of clients comprehensively, facilitating more personalized and strategic lending decisions.

Empowering Clients in Commercial Banking

-

Streamlined Onboarding Processes:

Integration platforms enhance the onboarding experience for commercial clients by simplifying and expediting the receipt of data and documents from the client along and the account setup. This efficiency ensures a smoother transition for clients entering a banking relationship.

-

Real-Time Access to Financial Information:

Clients benefit from real-time access to their financial data through integrated platforms. This transparency not only fosters trust but also allows clients to monitor their financial health actively, aiding in better decision-making.

-

Collaborative Communication:

Integration facilitates seamless communication channels between lenders and clients. Whether it’s sharing documents, discussing financial strategies, or providing status updates, the platform enhances collaboration, fostering a more engaged and satisfied clientele.

Addressing Challenges and Ensuring Security

-

Data Security Measures:

Robust security features embedded in integration platforms ensure the confidentiality and integrity of sensitive financial data. Banks can implement encryption, access controls, and regular security audits to safeguard against potential threats.

-

Regulatory Compliance:

Integration platforms can be configured to adhere to regulatory requirements, ensuring that data exchanges and processes comply with industry standards and legal frameworks, reducing the risk of non-compliance.

The Future of Commercial Lending: Integrated and Inclusive

In an era where efficiency, speed, and client satisfaction define success in commercial lending, integration platforms like IgniteConnex emerge as a essential elements of transformative change. By seamlessly connecting systems, automating processes, and enhancing collaboration, these platforms propel commercial lenders and their clients into a future where banking is not just a transaction but a dynamic and enriching partnership. Embracing integration is not just a technological upgrade; it’s a strategic imperative for those looking to thrive in the evolving landscape of commercial banking.

See how IgniteConnex can help your bank re-imagine the commercial loan process and be a cornerstone to your digital transformation, schedule a demo today.

Ignite the future

of your bank with

data and application

integration

Peapack-Gladstone Bank discusses their partnership with IgniteConnex and their parent company, CG Infinity.

Download Use Cases

Veritex Community Bank

Veritex Community Bank embarked on an ambitious digital transformation initiative to revolutionize its consumer and commercial onboarding procedures. However, the bank faced a multifaceted problem: how to seamlessly integrate its various systems to enhance processes, comply with regulations, and eliminate cumbersome manual tasks.

Download the whitepaper to learn how Veritex Community Bank connected its Digital Account Opening Solution to other digital transformation systems and its banking core.

.png)

CDFI

A Community Development Financial Institution (CDFI) needed to develop an integration strategy to facilitate information exchange in near real-time with external banks, NetSuite, and internal systems. The CDFI needed to create a unified/universal data model that would store data once and map system.

Download the whitepaper to learn more about how the CDFI solved this issue and implemented a near real-time solution to facilitate information exchange.

.png)

Peapack-Gladstone Bank

Peapack Gladstone Bank embarked on a plan to enhance their Wealth Management client online experience. The current state required customers to log in to multiple systems to access their account information. An aggregated view was imperative for ease of use and access.

Download the whitepaper to learn more about how PGB solved this issue and maintained its reputation for its distinguished white-glove service.

Nobody starts a business with the intention of only being around for a few years. As our world becomes increasingly digital, any company hoping to compete must keep up with constantly changing technology, and that includes financial institutions. More and more customers are doing the majority of their banking online, and many financial institutions are struggling to stay ahead of the curve. A digital transformation is one key to making sure your institution is still doing business five years from now.

Downward Trend in Bank Numbers

Over the past 30 years, the number of FDIC-insured institutions in the United States has plummeted at a precipitous rate. Since 1989, the number of banks has dropped from 14,469 to 4,236—a decrease of more than ten thousand closures. The average annual decline in the number of FDIC-insured banks has been 3.86% for the past decade. At this rate, the number of banks will be cut in half in the next 20 years, and by the 2080s, there could be as few as 450 FDIC-insured banks left in the country.

Small banks are far more likely to be victims of these closures than large banks. Banks with more than $100 billion in assets make up only 1% of the total banks in the United States but hold about 70% of the industry’s total assets. Meanwhile, only about one-third of small banks—those that hold less than $10 billion in assets– that existed in 1990 are still in operation. Mid-sized banks have seen both their assets and insured deposits decline by around 70% as well.

Branch Closures vs. Banking Access

It was once assumed that smaller banks would be able to compete with larger banks because of their more intimate connections with the communities in which they operate. But in 2020, spurred in part by the COVID-19 pandemic, many brick-and-mortar bank branches, including branches of large national banks, closed. While there was initial concern that this might create bank deserts—sections of the country without a bank within commuting distance—the American Bankers Association found that rural, low-income neighborhoods were more likely to have a local banking branch than affluent urban and suburban communities.

As online and mobile banking has become more widespread, the demand for in-person banking has fallen sharply. It no longer makes sense for banks to spend the overhead on staffing and maintaining multiple brick-and-mortar locations in the same location when most of their customers conduct the majority of their transactions on their mobile devices.

The Appeal of Digital Banking

Many banks were forced to shut down their in-person operations in March of 2020 when lockdown restrictions went into place, but the transition away from in-person banking was already well underway. Mobile banking provides more convenience. To visit a bank in person, a customer needs to find time in their schedule between work, errands, housekeeping, and social engagements. They then must commute to the bank, wait for a banker to be available, fill out paperwork, and then drive to their next appointment or back home.

With digital banking, customers have 24/7 access to their bank from anywhere they go. They can complete transactions, account openings, and more on their schedule. A well-designed digital onboarding system also requires less paperwork. Instead of needing to provide an ID for verification, customers can access their accounts with just a fingerprint or face scan.

What is a Digital Transformation?

A digital transformation is a fairly straightforward concept—transforming the way your financial institution operates to rely on more digital processes and emerging technologies. This isn’t as simple as turning your existing applications into fillable web forms and adding more computers to your office. A true digital transformation will require institutions to completely redesign the way they operate while seamlessly integrating all existing data.

What does digital transformation mean for financial institutions?

A digital transformation in financial institutions will include new technologies that use advanced data analytics and artificial intelligence, robust cybersecurity and privacy features, and an online customer experience optimized for ease and efficiency.

As digital banking becomes more widespread, hackers and other bad actors have more opportunities to commit fraud. To protect your institution and your customers, banks will need advanced cybersecurity protocols on both the backend and front end of their systems. Enhanced data analytics will help financial institutions profile customers and quickly and accurately determine how they will behave. Artificial intelligence can then use that data to automatically generate products, responses, or solutions for the customer.

Remaining Competitive

Customers need to be able to easily complete several common banking operations quickly and efficiently—transferring money, scheduling bill payments, making deposits, and opening accounts—from their phones or tablets. Financial institutions’ mobile applications and websites should put the user experience first. Designing a program that is intuitive, easy to navigate, and does not require extraneous information will help financial institutions make their services convenient and easily accessible to users. It should also be easy for customers to access support when they need it. The future of customer-facing business technologies is in figuring out what the customer wants or needs and giving it to them as quickly as possible. Going digital in an accessible and user-friendly manner is one of the keys to ensuring your business remains relevant in the next five years.

Key Takeaways:

- The number of FDIC-insured financial institutions is decreasing rapidly each year.

- Brick-and-mortar branch locations are becoming less common as more customers turn to digital banking.

- If a financial institution wants to stay in business over the next several years, they need to implement robust digital solutions that allow customers to do all or almost all of their banking via online or mobile channels.

- Customers need to be able to easily complete several common banking operations quickly and efficiently—transferring money, scheduling bill payments, making deposits, and opening accounts.

- Financial institutions’ mobile applications and websites should put the user experience first. Designing a program that is intuitive, easy to navigate, and does not require extraneous information.

- Going digital in an accessible and user-friendly manner is one of the keys to ensuring your business remains relevant in the next five years.

The IgniteConnex Solution

IgniteConnex provides a secure, user-friendly digital account opening technologies designed by bankers for bankers. We can help kickstart financial institutions’ digital transformation by enhancing the account application and approval process for new customers. Schedule a Demo to learn more!

Follow Us

Join us on social media to stay up to date on banking technology, executive insights, and industry news.