The Problem:

A medium-sized manufacturing firm encountered a significant hurdle in their financial operations. Their manual reconciliation process was proving to be both time-consuming and error-prone. Every month, the finance team had to painstakingly gather and input data from multiple bank accounts into their accounting system. This labor-intensive procedure resulted in delays, increased the risk of inaccuracies, and diverted valuable resources from more strategic financial activities.

The Solution:

Their bank worked with their team and provided a solution which included the following steps:

- Data Integration: A secure data integration pipeline was established between the firm’s bank accounts and their accounting system, enabling real-time, automated data transfer. This eliminated the need for manual data entry.

- Customized Reporting: Collaborating closely with the finance department, the bank’s IT team crafted tailored reconciliation reports to meet their specific requirements. These reports facilitated seamless transaction matching, discrepancy tracking, and financial statement generation.

- Automated Alerts: To enhance efficiency and minimize errors, automated alerts were implemented for detecting unusual transactions or discrepancies. This allowed the finance team to proactively address issues, reducing the risk of financial inaccuracies or fraud.

- Training and Support: Comprehensive training was provided to the finance team to ensure they could effectively utilize the new system. Ongoing support was also offered to address any queries or concerns during the transition.

Benefits to the Client:

The solution implemented by the bank yielded numerous advantages for this firm:

- Time Savings: The automated reconciliation process saved the finance team a substantial amount of time each month, enabling them to concentrate on more strategic financial tasks.

- Reduced Errors: With the reduction of manual data entry, the risk of human error was significantly minimized, resulting in more accurate financial reporting and improved compliance.

- Enhanced Visibility: Real-time data integration and tailored reporting offered the firm improved visibility into their financial data, empowering them to make well-informed decisions.

- Cost Savings: The elimination of manual data entry and reduced error risk translated into operational cost savings for the firm.

- Increased Efficiency: The implementation of automated alerts and proactive issue resolution streamlined financial processes, reducing the chances of financial discrepancies slipping through undetected.

- Improved Security: The establishment of a secure data integration pipeline ensured the confidentiality and integrity of the firm’s financial data.

The bank’s solution not only effectively addressed the firm’s immediate reconciliation challenges but also positioned them for sustained financial efficiency, accuracy, and security in the long run. The bank was able to leverage this solution to serve other clients and increase their affinity and stickiness.

IgniteConnex can help.

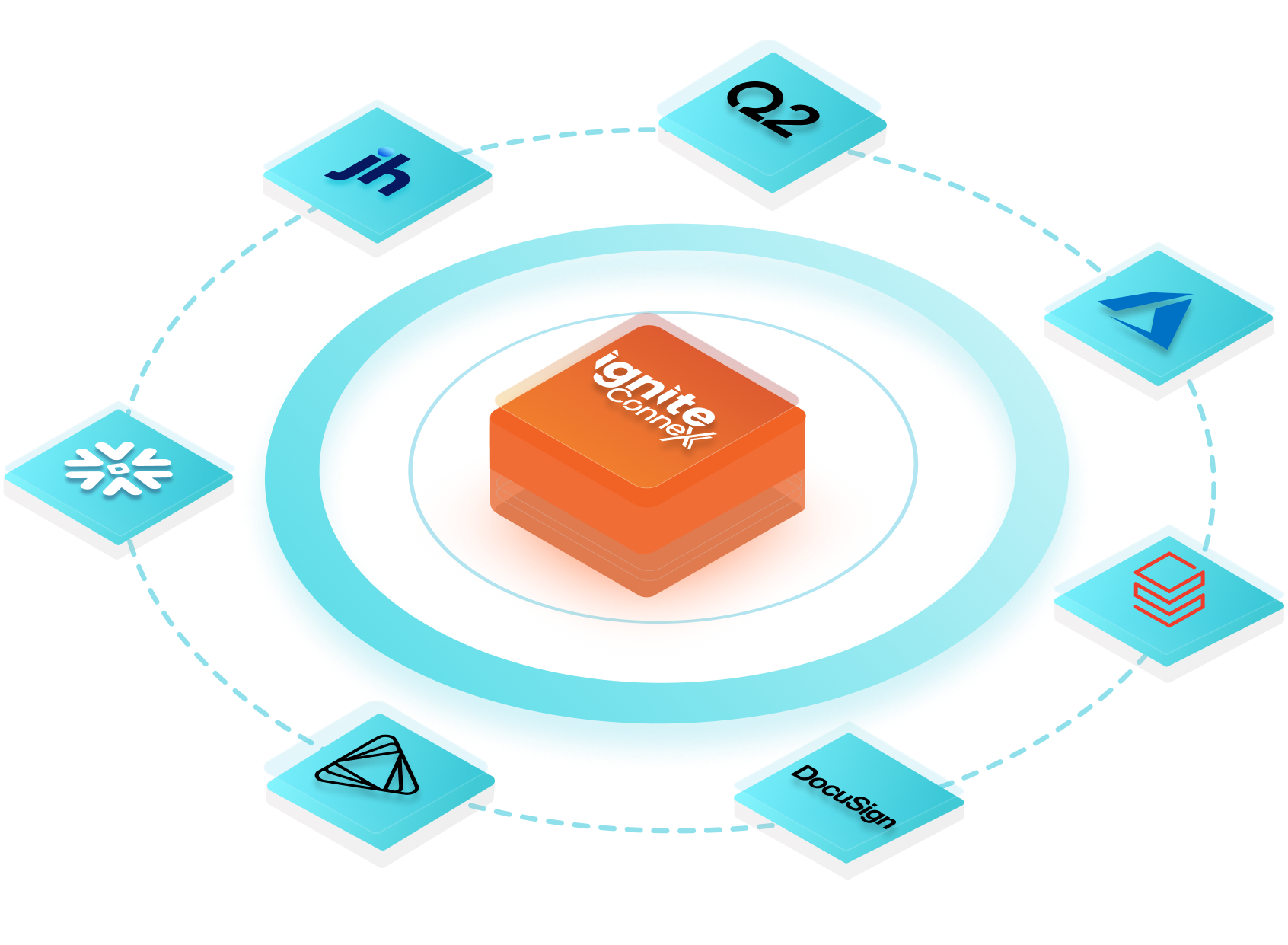

Banks and Credit Unions play a pivotal role in our financial ecosystem, ensuring the efficient management of our money and investments. However, many financial institutions are grappling with a common challenge – a complex web of legacy technology systems that do not natively integrate with each other. This lack of integration often necessitates manual or batch processes to facilitate more complex use cases that involve multiple systems. In response to this issue, integration platforms have emerged as a solution to enhance capabilities, reduce manual processes, and provide a modular approach that supports the seamless transition from legacy systems when needed.

The Problem

- Legacy Technology Systems: Many banks and credit unions have been operating for decades, accumulating a patchwork of legacy systems along the way. These systems were often developed in isolation, resulting in a lack of interoperability.

- Manual and Batch Processes: With these disparate systems in place, financial institutions often resort to manual or batch processes to bridge the gaps between them. This not only leads to inefficiencies but also increases the risk of errors.

- Limited Agility: The inability to integrate systems quickly and efficiently hampers the ability of banks and credit unions to respond to changing market dynamics and customer demands. This lack of agility can be a significant drawback in an era of rapid technological advancements.

- Costly Maintenance: Maintaining and updating multiple legacy systems is a costly endeavor, both in terms of time and financial resources. Moreover, finding and retaining personnel with expertise in older technologies can be challenging.

The Solution

Integration platforms are the answer to the challenges posed by legacy systems in the banking and credit union sector. Here’s how they can transform the landscape:

- Seamless Integration: Integration platforms act as intermediaries that connect disparate systems, allowing data and processes to flow seamlessly between them. They provide a unified interface through which data can be accessed and manipulated, eliminating the need for manual interventions.

- Modular Approach: These platforms offer a modular approach to integration, allowing institutions to choose the components they need and discard or replace legacy systems gradually. This flexibility reduces the disruption caused by system transitions.

- Automation: Integration platforms enable automation of repetitive tasks and workflows, reducing the reliance on manual processes. This not only improves efficiency but also minimizes the risk of errors associated with human intervention.

- Real-time Data Access: Banks and credit unions can access real-time data from multiple systems, empowering them to make informed decisions quickly. This capability is invaluable in a fast-paced financial industry.

- Enhanced Security: Integration platforms often come equipped with robust security features, ensuring that sensitive financial data remains protected as it flows between systems.

Benefits

The adoption of integration platforms can yield numerous benefits for banks and credit unions:

- Improved Efficiency: By automating processes and eliminating manual interventions, financial institutions can streamline operations, reduce processing times, and improve customer service.

- Enhanced Customer Experience: Real-time access to customer data allows for more personalized services and quicker responses to customer inquiries, ultimately leading to a better customer experience.

- Cost Savings: Over time, the reduction in manual processes and the ability to retire costly legacy systems can result in significant cost savings for financial institutions.

- Agility and Innovation: Integration platforms empower banks and credit unions to respond swiftly to market changes and adopt innovative technologies without the constraints of legacy systems.

- Compliance and Risk Management: With better control over data and processes, institutions can more effectively manage compliance requirements and mitigate risks associated with manual errors.

Conclusion

In a rapidly evolving financial landscape, the ability to adapt and innovate is paramount for banks and credit unions. Integration platforms offer a compelling solution to the longstanding challenge of legacy technology systems that hinder progress. By providing seamless integration, a modular approach, and automation capabilities, these platforms empower financial institutions to enhance efficiency, improve customer service, reduce costs, and stay competitive in a dynamic industry. Embracing integration platforms can pave the way for a brighter and more prosperous future for the banking and credit union sector.

IgniteConnex can help.

In the fast-paced world of modern banking, the demand for cutting-edge data and analytics capabilities has never been greater. Financial institutions must constantly strive to serve customers better, drive revenue and deposits, and enhance operational efficiency. Achieving these goals, while maintaining security, scalability, flexibility, and speed to market, is a formidable challenge. Enter IgniteConnex, our pioneering integration platform, which is poised to redefine the future of banking.

Security

Data security is of paramount importance in the financial sector, and IgniteConnex addresses these stringent requirements. Our platform offers multi-layered security measures, including robust data encryption, access controls, and stringent authentication protocols. It is built on a foundation of bank-grade security, ensuring that sensitive customer data remains protected at all times.

With IgniteConnex, banks can confidently adhere to strict compliance standards while reinforcing customer trust. The platform is designed for real-time threat detection and response, actively monitoring for vulnerabilities, ensuring that your data remains as secure as possible.

Scalability

Scalability is a pivotal factor in the banking landscape. IgniteConnex has been designed to handle the growing data demands of financial institutions, offering broad scalability. Whether your bank is a small community institution or a global powerhouse, our platform can adapt to your specific requirements.

No more concerns about hardware constraints or capacity planning. IgniteConnex’s cloud-native architecture allows you to scale up or down as needed, guaranteeing that you always have the resources to support your data and analytics initiatives. This flexibility empowers your bank to remain agile and responsive to market changes.

Flexibility

Each bank has unique needs, and IgniteConnex embraces this diversity. Our platform provides a versatile ecosystem that enables banks to select the technologies, tools, and applications that align with their individual requirements. Whether you prefer on-premises solutions or cloud-based services, IgniteConnex seamlessly integrates them into a cohesive system.

Our platform is compatible with a wide variety of data sources, simplifying the process of gathering and analyzing data from various channels, such as customer transactions, social media, and market trends. This adaptability enables banks to gain a comprehensive view of their operations and customers, facilitating more informed decision-making.

Rapid Time to Market

In the competitive world of banking, time is of the essence. IgniteConnex accelerates your time to market by simplifying the integration process and reducing development cycles. The platform’s pre-built connectors and templates expedite the connection of disparate systems and data sources, allowing banks to swiftly roll out innovative services and analytics solutions.

This speed-to-market advantage is invaluable for banks aiming to stay ahead of the competition. With IgniteConnex, financial institutions can promptly launch new products and services, respond to market trends, and adapt to changing customer expectations.

Best Practices for Implementation

1. Define Clear Objectives:

Before embarking on the implementation journey, it’s crucial to define clear and measurable objectives. Outline what you aim to achieve with IgniteConnex, such as improving customer analytics, streamlining operations, or launching new data-driven services. This clarity helps set the direction for the implementation and provides a framework for assessing success.

2. Engage Stakeholders:

Involving key stakeholders from various departments within your bank is essential. These stakeholders can include IT teams, data analysts, compliance officers, and business leaders. Their input is valuable in understanding specific needs, ensuring alignment with organizational goals, and addressing any concerns or requirements unique to each department.

3. Comprehensive Training:

To maximize the utilization of IgniteConnex, comprehensive training is imperative. Ensure that your team is well-versed in using the platform’s features and functionalities. IgniteConnex may offer training resources and support services to help your staff become proficient users. Regular training sessions and refresher courses can keep your team up to date with the latest platform capabilities.

4. Data Governance:

Robust data governance practices are essential for maintaining data integrity, security, and compliance. Create clear data governance policies and procedures that dictate how data is collected, processed, stored, and shared within your bank. Regularly audit and monitor data usage to ensure it adheres to these policies. Data governance also includes defining data ownership and access controls, which help in safeguarding sensitive information.

5. Documentation and Knowledge Sharing:

Comprehensive documentation of the implementation process is vital for knowledge sharing and continuity. Document configurations, integration workflows, and best practices as they are established. This documentation serves as a valuable resource for new team members, reduces reliance on specific individuals, and facilitates troubleshooting and future enhancements.

6. Disaster Recovery and Business Continuity:

Develop a robust disaster recovery and business continuity plan that covers IgniteConnex and the critical data and systems it integrates. This plan should include regular backups, redundancy measures, and a clear strategy for recovering from unexpected events, ensuring minimal disruption to your banking operations.

By adhering to these best practices, your bank can effectively implement IgniteConnex and leverage its capabilities to their full potential. This comprehensive approach fosters a smooth transition to the platform, ensures ongoing optimization, and positions your bank for success in the data-driven, analytics-focused banking landscape.

IgniteConnex is the ideal choice for financial institutions seeking to enhance their data and analytics capabilities. Its security, scalability, flexibility, and rapid time-to-market features provide banks with the tools they need to elevate customer experiences, drive revenue and deposits, and streamline operations.

By choosing IgniteConnex, your bank can confidently embrace the digital era, knowing you have a powerful, secure, and adaptable platform at your disposal. IgniteConnex isn’t just an integration platform; it’s the catalyst for transformation and innovation in the banking industry. Join us, and together, we’ll ignite the future of banking.

Ignite the future

of your bank with

data and application

integration

IgniteConnex bridges traditional banking can steer your bank’s digital evolution with modern technology, enhancing customer experiences and efficiency.

Download Use Cases

Veritex Community Bank

Veritex Community Bank embarked on an ambitious digital transformation initiative to revolutionize its consumer and commercial onboarding procedures. However, the bank faced a multifaceted problem: how to seamlessly integrate its various systems to enhance processes, comply with regulations, and eliminate cumbersome manual tasks.

Download the whitepaper to learn how Veritex Community Bank connected its Digital Account Opening Solution to other digital transformation systems and its banking core.

.png)

CDFI

A Community Development Financial Institution (CDFI) needed to develop an integration strategy to facilitate information exchange in near real-time with external banks, NetSuite, and internal systems. The CDFI needed to create a unified/universal data model that would store data once and map system.

Download the whitepaper to learn more about how the CDFI solved this issue and implemented a near real-time solution to facilitate information exchange.

.png)

Peapack-Gladstone Bank

Peapack Gladstone Bank embarked on a plan to enhance their Wealth Management client online experience. The current state required customers to log in to multiple systems to access their account information. An aggregated view was imperative for ease of use and access.

Download the whitepaper to learn more about how PGB solved this issue and maintained its reputation for its distinguished white-glove service.

Follow Us

Join us on social media to stay up to date on banking technology, executive insights, and industry news.