Why IgniteConnex?

IgniteConnex Uniting Legacy Systems, New Technologies, and Fintech Innovations for Unique Customer Offerings

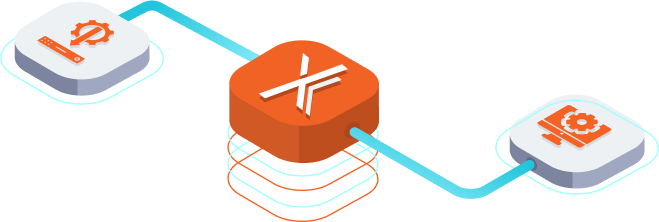

Preserving Legacy IT Investments

IgniteConnex stands as a reliable bridge that seamlessly connects your existing legacy systems with modern digital interfaces. By preserving your substantial IT investments, you can tap into the wealth of historical data and the proven reliability of these systems while embracing the innovative potential of new technologies.

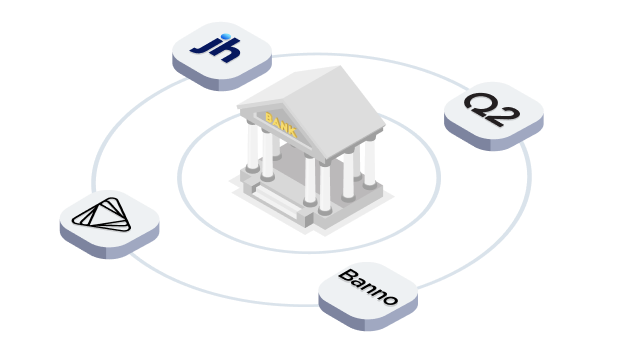

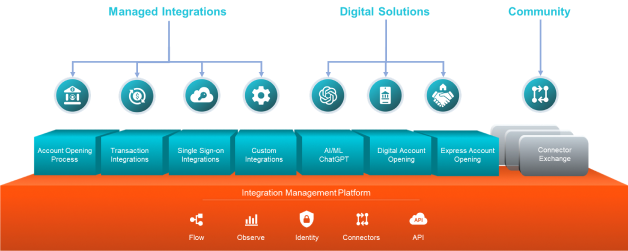

Embracing New Systems and Fintechs

IgniteConnex is designed to accommodate the integration of new systems and fintech innovations effortlessly. This means you can easily plug in cutting-edge tools and technologies to augment your existing infrastructure, expanding your capabilities and staying ahead of the competition.

Creating Unique Customer Products and Services

With IgniteConnex’s ability to integrate new systems and fintechs, you gain the power to craft unique and tailored offerings for your bank’s customers. Leverage innovative fintech solutions to provide enhanced digital banking experiences, personalized financial products, and services that cater to specific customer needs.

Creating Unique Customer Products and Services

With IgniteConnex’s ability to integrate new systems and fintechs, you gain the power to craft unique and tailored offerings for your bank’s customers. Leverage innovative fintech solutions to provide enhanced digital banking experiences, personalized financial products, and services that cater to specific customer needs.

Unlocking Synergies

By combining the strengths of your legacy systems with new technologies and fintech offerings, you can unlock synergies that drive operational efficiencies and customer satisfaction. Seamlessly blending the best of both worlds allows you to create a cohesive and powerful ecosystem that enriches the overall banking experience.

Accelerating Digital Transformation

IgniteConnex accelerates your bank’s digital transformation journey by providing a single, unified platform that brings together diverse technologies and systems. This integration optimizes processes, reduces friction points, and streamlines the development of new digital services, ensuring your bank remains at the forefront of the digital revolution.

Enhanced Competitiveness

By leveraging IgniteConnex to create unique customer products and services, your bank gains a competitive edge in the market. The ability to offer innovative, personalized solutions sets your institution apart, attracting new customers and strengthening loyalty among existing ones.

Follow Us

Join us on social media to stay up to date on banking technology, executive insights, and industry news.